Futures allow you to lock in predetermined prices to purchase or sell at a later time, which might be beneficial to your trading strategy. It’s a fantastic approach for you to protect yourself from market fluctuation and negative price changes. However, futures could be risky.

Various assets can be traded in futures, yet an advanced platform is required. You might find it difficult to choose the best futures trading software because there are so many of them accessible.

Contents:

• What are Stock Market Futures?

• How Accurately Do Futures Predict the Stock Market?

• Best Apps for Futures Trading

• Best Futures Trading Platforms:

- TradeStation: Best Desktop App for Futures Trading

- TopStep

- Coinlocally

- Tastyworks ($200 bonus)

- TDAmeritrade: Best Mobile App for Futures Trading

- InteractiveBrokers

- E-Trade

• Brokerage Commissions/Order Routing Fee

• Futures Clearing Merchant Fee

What are Stock Market Futures?

The ability to forecast the future with accuracy has long been ranked as one of the most desirable super abilities. Knowing what’s ahead allows you to make the necessary preparations and use opportunities effectively.

With “stock market futures” contracts, also known as “equity index futures” or simply “futures,” the stock market provides a view into the future. Continue reading to find out more about how these tools function and how you can harness a financial superpower.

Stock futures are contracts that follow a particular benchmark index at a future date. They are also known as market futures, equity futures, equity index futures, or stock futures. They keep tabs on undexes and go by the name:

Futures contracts on the stock market that follow a particular benchmark index

Stock futures are contracts that follow a specified benchmark index at a future date. They are also known as market futures, equity futures, equity index futures, or stock futures. They track indexes and are given the following names:

- • e-Mini S&P 500 Futures,

- • e-Mini Nasdaq Futures, and

- • e-Mini Dow Futures

The direction of the underlying equity index can be traded using stock market futures, which can also help you hedge equity positions you have in your portfolio. They can assist you by acting as a forward-looking indication for the movement of the stock market.

Futures are a type of derivative financial contract that binds you to buy or sell an asset at a specific price and time in the future. They are distinct from options in that you agree to execute this contract, whereas options only provide you the opportunity to do so.

When you buy a stock market futures contract, regardless of the market price at expiration, you commit to purchasing the underlying asset (such as an equity index) at the predetermined price and date. Similar to buying a futures contract, selling a futures contract must be done in line with the terms of the contract.

Stock Market Futures are derivative financial contracts that bind buyers and sellers to buy or sell an asset at a specific price and time in the future.

How Accurately Do Futures Predict the Stock Market?

It would be inaccurate to imply that futures could forecast the direction of the stock market. While stock market futures indicate the market’s intended course, they primarily serve as a wager on the direction in which the market is most likely to go going forward.

A futures contract serves as a promise to purchase or dispose of the underlying asset at a given time and price. Counterparties attempt to use these futures contracts to match their financial risk/reward with this intelligence by anticipating which way the market will move.

Futures contracts, in essence, show the direction that investors believe the market will go. A loss for one investor (or upside that is locked in or limited) is, nevertheless, a gain for another because investment is zero sum.

Futures do not accurately predict the direction of the stock market, but rather serve as a wager on the direction in which the market is likely to go.

Best Apps for Futures Trading

The ideal stock tracking app may not be the same for different people. Most likely, one of the following is your best option:

- TradeStation is the best desktop futures trading application.

- TopStep is the best funded futures trading application with links to other brokers.

- Tastyworksis the best social trading platform.

- Coinlocally is the best desktop and mobile app for futures trading.

- TDAmeritradeis the best mobile futures trading software.

- eTradeis the best futures trading app with options trading.

- InteractiveBrokersis the best futures trading app for professionals is.

Let’s take a closer look at the top choices and their features.

Best Futures Trading Platforms

You will need an app that enables you to transact based on your research and preferences if you want to trade stock market futures. You can place futures trades alongside other sorts of investing transactions using the best stock market futures trading apps on the list below.

1. TradeStation

With its full powerhouse of features and market-leading technology, TradeStation offers a wide range of platforms, including desktop, web, and mobile apps.

The service’s features include charting (nearly 300 technical indicators), scanner, matrix (for ladder trading), and advanced strategy testing. Radar Screen allows for 335 configurable columns of data with real-time streaming quotations.

Best Trading Platform for Professionals

• TradeStation is a robust trading platform with analytical tools useful to both experienced pros and inexperienced traders.

• The platform is furnished with brokerage services and trading education materials that have been approved by well-known industry reviewers.

Features and capabilities for professional trading; broad range of tradable assets, including futures, micro futures, and futures options.

• Simple trading tools and interfaces

• Reasonably priced for trading volume

Cons: Expensive fees for transactions involving little amounts of bitcoin; unclear and inconsistent costs for particular actions or events; sophisticated tool primarily intended for skilled traders.

• Mac users can only utilize a Windows emulator to use the TradeStation desktop platform.

2. TopStep

TopStep is a fintech company that assesses your trading performance using simulated accounts that operate in real time. You can gain access to a funded account worth $30,000 to $150,000 and trade futures contracts using the firm’s funds if you pass the company’s evaluation.

Funded traders have access to the most popular CME products as well as futures contracts ranging from crude to the E-mini S&P 500. You can choose the buying power that best suits your trading style after starting a 14-day free trial as a starting point.

You get to retain 80% of everything you earn after the first $5,000 and 100% of the first $5,000.

You’ll need to demonstrate your profitability and risk management skills over a period of time that has been set by the organization.

They offer these guidelines to inculcate good behaviors and view them as a ticket to dependable prosperity for investing in things that pay off well.

Additionally, they provide a Trading Combine to help you get ready to trade the firm’s funds by teaching you how to manage risk and grow an account.

• TopStep allows you to trade futures using their funds as long as you can show that you have the ability to consistently earn a profit and control risk.

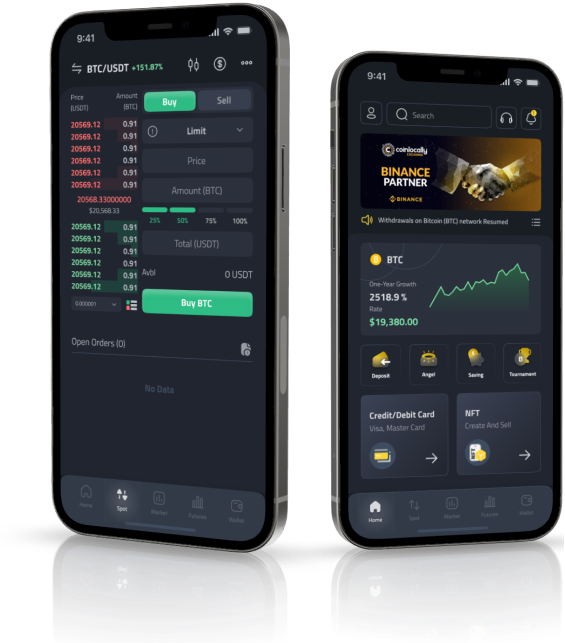

3. Coinlocally

The Coinlocally platform has been working to lower obstacles to bitcoin adoption among newcomers and non-coiners. With its user-friendly UX/UI and feature-rich toolkit, this next-generation cryptocurrency trading service achieves this goal.

Coinlocally, as one of the best brokers for futures trading, is another cryptocurrency exchange platform, offering over 600 CryptoCurrencies and a wide range of Fiats for buying and selling Crypto. It offers Centralized and Dex (Decentralized Exchange), as well as numerous features including trade in Spot and Derivatives (Futures Trading Platform).

What’s new in Coinlocally?

- • Spot trading instruments are added to mobile applications and web interfaces

- • Applications have the futures trading module activated;

- • Saving dashboards are available in mobile applications and web interfaces;

- • NFT marketplace

- • Coinlocally Coin (CLYC) Q4 of 2022.

Coinlocally is ready to take the lead in the market for beginner-friendly cryptocurrency trading and saving ecosystems once this update is launched.

A big update to the multi-product, beginner-friendly cryptocurrency ecosystem Coinlocally sees the introduction of spot and futures trading in its applications and web interfaces.

4. Tastyworks ($200 bonus)

The original creators of the renowned thinkorswim trading technology launched the award-winning, self-directed brokerage known as tastyworks (now owned by TDAmeritrade).

In addition to the standard suspects of stocks and ETFs, the site also offers reasonable commissions on options ($1/transaction on stock and ETF options) and cryptocurrencies (1% commission on trading volume up to a $10 maximum).

The platform gives users the option to interact with cutting-edge, paradigm-shifting technology that anticipates futures traders’ demands.

The program seeks to alleviate “trader’s block,” or the equivalent of writer’s block for traders. It allows users to follow traders on the platform and participate in video broadcasts with others to talk about all things market-related.

Additionally, the service has a partnership with tastytrade, a financial news network only dedicated to discussing trading.

The services claim to “convert you from a fearful beginning to a confident, everyday trader” when used together.

TastyWorks

Stocks & ETFs: $0; Stock & ETF Options: $1/contract; Futures: $1.25 per trade

- • Do-it-yourself brokerage offering stocks, ETFs, options, crypto and futures trading

- • Company started by original founding thinkorswim team

- • Relies on competitive rates and cutting-edge technology to empower individual retail traders

- • Deposit Bonus: Get $200 in stock* if you open a new account and deposit $2,000 or more

Do-it-yourself brokerage offering stocks, ETFs, options, crypto, and futures trading; company founded by the original founding thinkorswim team; relies on competitive rates and cutting-edge technology to empower individual retail traders; deposit bonus: Get $200 in stock* if you open a new account and deposit $2,000 or more;

5. TDAmeritrade

TDAmeritrade, a more conventional broker, provides a strong trading platform for stock market futures.

A wide range of investment tools are available on the company’s thinkorswim platform, including paper trading, an earnings analyzer, charts with nearly 500 indicators (including personalized candlestick patterns), backtesting, and historical market replays.

In addition to many other asset classes, the service provides a desktop and mobile trading experience for stock futures.

6. InteractiveBrokers

Interactive Brokers provides access to the broadest range of order types.You can execute any deal, whether manually or in accordance with algorithm instructions you’ve built up, thanks to the wide variety of order types available.

Retail traders adore Interactive Brokers because it offers the best margin rates in the market, which is why many institutions select it. This app caters to professionals and has a high margin account minimum deposit of $110,000.

![]()

7 E-Trade

Unlike these other companies, E*Trade doesn’t have a stand-alone desktop platform. Instead, it provides a mobile app and a web-based trading application.

The program offers excellent capability for trading options, but it doesn’t perform quite as well as the others in terms of day trading features or customization.

• Commodity trading systems that are best in class, a wide choice of investments (including professionally managed accounts), and zero commission for online trades in US-listed stocks, ETFs, and options.

• Creating an account is simple and just needs a few minutes.

![]()

TradeStation, TopStep, Tastyworks, Coinlocally, TDAmeritrade, eTrade, and InteractiveBrokers are the best stock tracking apps for futures trading.

Trading Futures Costs

You should think about the types of trading costs you will spend on these platforms when deciding which stock market futures software to use for placing your bets. The most frequent charges and commissions associated with the apps mentioned above are listed below.

· Brokerage Commissions/Order Routing Fee

Many brokers had to modify their charge and commission schedules when Robinhood joined the market in order to stay competitive. Trading commissions were reduced to $0 by the corporation, and it monetized new sources of income, particularly through the sale of order flow.

Each year, their Payment for Order Flow (PFOF) generates hundreds of millions of dollars in revenue for the corporation, which many retail brokerages have been forced to adopt in order to stay competitive.

When apps like Robinhood were discovered by their clearing house for requiring more funds on deposit to comply with regulatory requirements during the GameStop market frenzy, we thought this to be troublesome.

Paying brokerage commissions should therefore help to keep your orders hidden from larger stock market participants while also sounding awful on the surface.

· Futures Clearing Merchant Fee

Your broker must become a Futures Commission Merchant (FMC) in order to trade futures contracts. These institutions are crucial in allowing clients to take part in futures markets.

These entities solicit or accept orders to buy and sell futures or options on futures in exchange for cash payments, or commissions from trading. Additionally, customers’ margin interest must be collected by FCMs, and delivery of assets after a future contract expiration must be guaranteed.

· Exchange Fee

Exchange charges for clearing and trading CME Group products vary, according to the Chicago Mercantile Exchange. Trades on the CME, CBOT, or NYMEX/COMEX Exchange may be subject to exchange fees based on the product, the volume transacted venue, and/or the type of transaction, depending on various memberships or incentive programs.

· National Futures Association Fee

This small cost, which is paid by the Futures Clearing Merchant, is $0.02 per side. Both dealer and exchange-traded options are subject to the charge.

· Miscellaneous Fees

Depending on the type of trade, amount made, type of deal, and other contributing factors, you can be charged additional fees by your broker.

Brokers must become an FMC to trade futures contracts, and customers’ margin interest must be collected by FCMs. Exchange charges vary depending on product, volume, venue, and type of transaction.

The Bottom Line

You must take into account a variety of things in order to select the stock market futures software that is ideal for your requirements. Before you start trading futures, you must be familiar with the basics of the terminology; otherwise, you’ll rapidly become confused attempting to grasp how to use the various phrases.

Because fluctuations in corporate profitability and altering investor expectations for future earnings cause stock values to fluctuate quickly. The movement of stock futures can occur for a variety of non-company-specific reasons.

Natural calamities, economic indicators, political consequences, or a variety of other factors could prompt someone to relocate.

Someone might move because of natural disasters, economic indicators, political repercussions, or a variety of other reasons. The top customer service options, dependability, and the security you may anticipate for your money should be your main concerns. Without a doubt, these costs become well worth the money spent if your futures broker levies fees like $0.25 to pay them.

Your level of experience in terms of system support, trading tactics, and execution will be matched by the ideal futures broker. Your broker may discuss with you as you develop your skills to choose the best course of action for your requirements.

Futures software must be familiar with terminology, investor expectations, and customer service options.