Protecting capital and controlling your trades is essential in fast-paced financial markets, whether you’re trading stocks, crypto, or commodities. A well-placed order can differentiate between minimizing loss and missing an opportunity. One of the most precise tools available to traders is the stop-limit order. Although it sounds complex, this order type is easy to understand and incredibly powerful when used correctly.

This article explains a stop-limit order, how it compares to other standard order types, when to use it, and how to set one up on platforms like Coinlocally. Mastering this tool is a significant step in taking greater control of your trade execution.

Table of Contents

What Is a Stop-Limit Order?

This type of order is a hybrid between a stop and a limit order. It’s designed to give traders more control by letting them specify when an order is activated and the price they’re willing to buy or sell.

A stop-limit order includes two key components:

- Stop Price: The price that triggers the limit order.

- Limit Price: The price at which the order will be placed, once the stop is triggered.

Here’s an example: Suppose Solana is trading at $200. If it drops to $195, you want to sell, but don’t want to accept less than $194. You would set:

- Stop: $195

- Limit: $194

If the market hits $1,950, your sell order at $1,940 is placed. It will only execute at that price or better, never lower.

Stop-Limit vs. Stop-Loss: What’s the Difference?

Although they sound similar, these orders serve different purposes. When triggered, a stop-loss turns into a market order, executing immediately at the best available price, often worse than expected during sharp market moves. In contrast, a stop-limit order executes as a limit order at your defined price, providing control but not execution certainty.

| Feature | Stop-Loss | Stop-Limit |

| Order Type | Market | Limit |

| Price Control | None | Yes |

| Execution Risk | Low | Moderate (not guaranteed) |

| Use Case | Quick exits | Controlled entries/exits |

When Should You Use It?

This type of order is helpful in various scenarios:

Protecting Profit

You’ve bought Bitcoin at $25,000, now trading at $30,000. To protect gains, you stop at $29,500 with a limit of $29,400. If the market dips, your position exits with profits, as long as someone is willing to buy at your set price.

Reducing Downside Risk

If a stock drops below a support level, setting a stop-limit can help you exit before more losses pile up, while avoiding a panic sell at an undesirable price.

Precise Entry Points

Let’s say a coin is consolidating under resistance at $1.00. You anticipate a breakout and want to enter at $1.01 but not pay more than $1.03. To capture the breakout with price control, you can set the stop at $1.01 and the limit at $1.03.

Volatile Asset Trading

A stop-limit order is helpful in the crypto world, where prices can move 5–10% in minutes. It helps avoid emotional decisions and wild price swings.

Benefits of Stop-Limit Orders

- Price Precision: You’ll never sell too low or buy too high.

- Strategic Risk Management: Define exits ahead of time.

- Automation: Works even when you’re offline.

- Suitable for Breakouts: Ensures you enter trends only if confirmed.

Drawbacks to Consider

- No Execution Guarantee: If the price skips past your limit, the trade won’t fill.

- Too Tight a Range: Placing your stop and limit too close may cause missed trades.

- Complexity: Beginners may find it more confusing than standard order types.

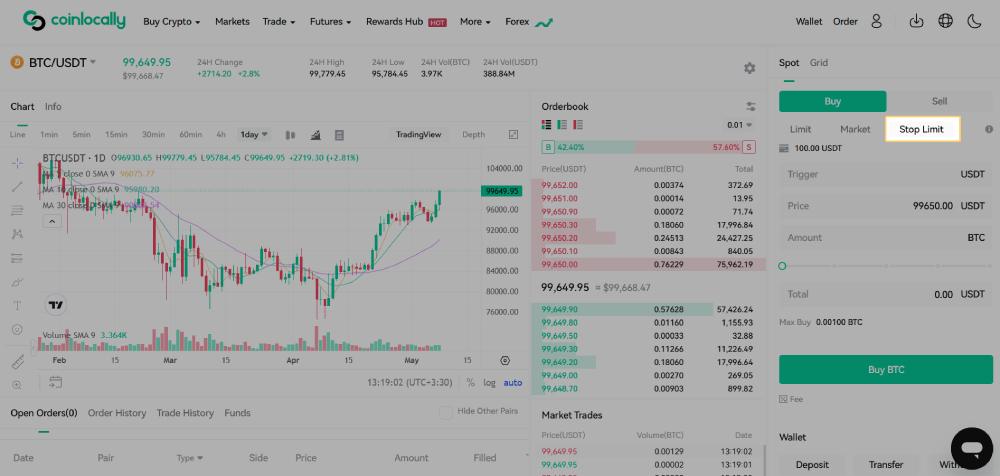

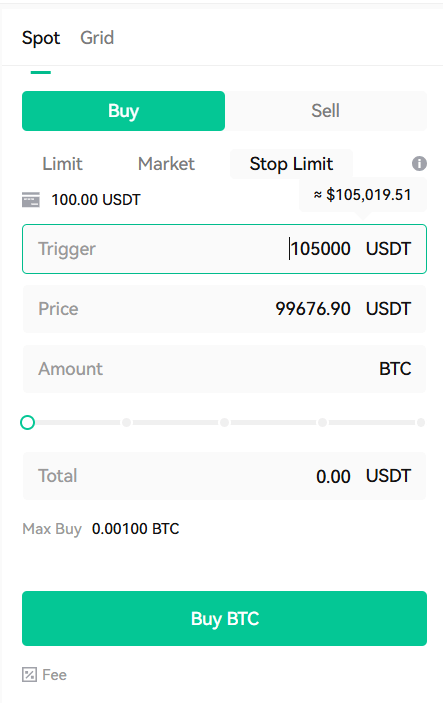

How to Place One on Coinlocally (Example)

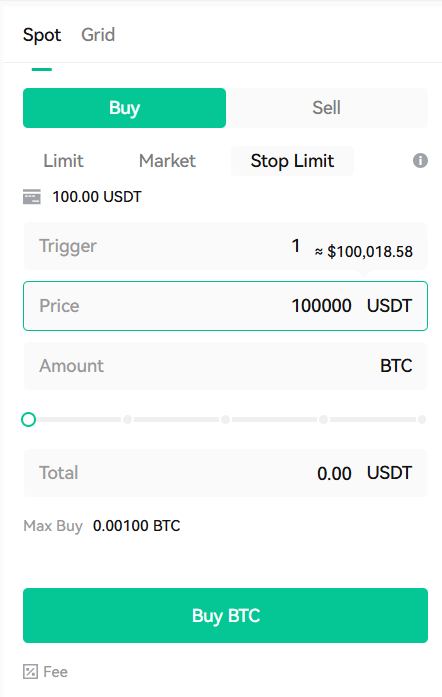

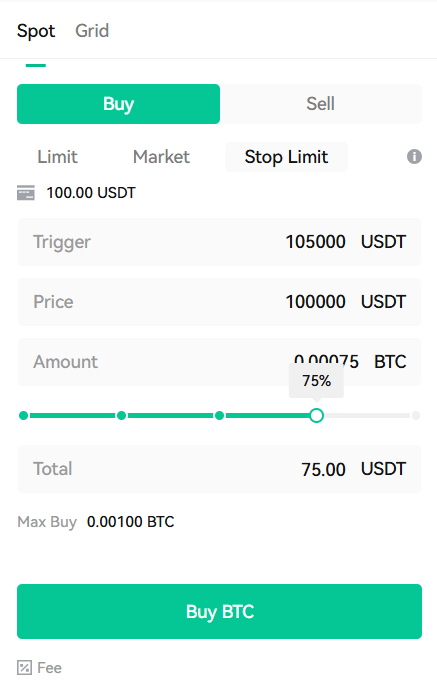

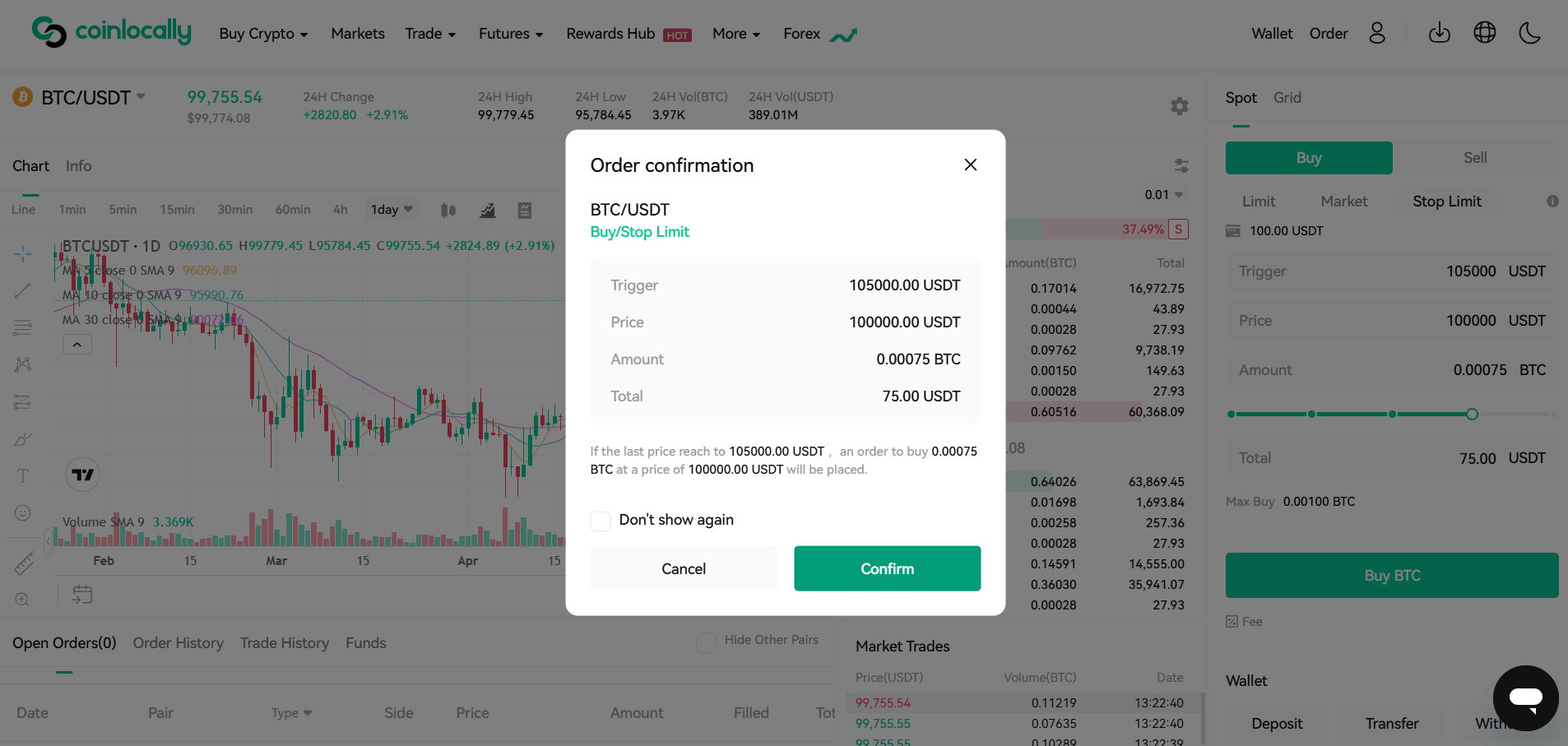

1. Navigate to the trading interface.

2. Select “Stop-Limit” from the order options.

3. Enter your stop price (trigger point).

4. Set your limit price (execution point).

5. Define how much of the asset you want to trade.

6. Confirm and place the order.

Once triggered, your order becomes visible on the order book and executes only if the market matches your conditions.

Tips for Using It Effectively

- Don’t set the stop and limit prices too close. Give your trade space to fill.

- Use technical analysis. Place your order near key support or resistance levels.

- Consider volatility. In fast markets, adjust your prices accordingly.

- Start small. Test this strategy with smaller trades to learn how your platform handles execution.

Why It’s Especially Useful in Crypto

Markets like Bitcoin, Ethereum, and altcoins are known for their rapid price movements. A stop-limit order allows crypto traders to:

- Lock in gains without watching the market 24/7

- Avoid slippage in large orders

- Enter trends only after they’re confirmed

- Manage positions during news-driven volatility

Platforms such as Coinlocally, Binance, Coinbase Pro, and Kraken offer this order type with user-friendly interfaces, making it accessible even to intermediate traders.

Final Thoughts on Stop-Limit Order

The stop-limit order is a powerful tool that gives traders more precision in managing trades. By allowing you to define both a trigger and execution price, it offers the best of both worlds: risk control and price discipline. Whether you aim to protect profits, limit losses, or enter a confirmed breakout, using this order type can significantly enhance your strategy.

While it doesn’t guarantee execution, it does ensure that your trade will never fill at a worse price than you’ve defined. For experienced traders, it’s a crucial part of their risk management arsenal. It’s an excellent way for beginners to build more disciplined and automated trading strategies.

As with all trading tools, the key to successful use is understanding. Practice on small trades, analyze results, and adjust based on your goals and market conditions. Once you master it, the stop-limit order becomes reliable in any market environment.