Forex trading strategies for beginners play a leading role in trading forex, a market that is the world’s largest and most liquid financial market. With a daily trading volume of $6.6 trillion, it is more than double that of the New York Stock Exchange, making it an appealing trading venue.

Forex trading strategies for beginners can be a lucrative endeavor for those who are ready to accept the risk and trade currencies. However, there are numerous mistakes that newcomers should avoid if they wish to succeed in the long run.

By reading this article, you will learn about Effective Forex trading techniques for beginners and what they need to do to be successful in the forex market. But first, you must grasp what a forex trading strategy is and how to select the best one for you.

Quick Getaway: Looking for the best Forex trading platforms? Coinlocally offers Meta Trader 5, one of the best Forex trading platforms Sign up here.

Table of Contents

• What is a Forex Trading Strategy?

• Best Forex trading strategies for Beginners

• Effective Forex Trading Techniques for Beginners

- Price action trading

- Range trading strategy

- Trend trading strategy

- Position trading

- Day trading strategy

- Scalping strategy

- Swing trading

- Carry trade strategy

- Breakout strategy

- News trading

- Retracement trading

- Grid trading

• How to Distinguish the Best Forex Trading Strategies for Beginners

• Forex trading strategies for beginners summed up

• Risk Management in Forex Trading

What are the Forex Trading Strategies for Beginners?

Forex trading strategies for beginners is a set of rules that a trader uses to determine when to join a transaction, how to manage it, and when to close it. Simple forex trading strategies for newbies can be quite sophisticated, depending on the trader.

Technical analysis for beginner forex traders will find it easier to determine their entry/exit rules, however, traders who use fundamental analysis in forex trading strategies for beginners may find it more challenging because there is more discretion involved. Regardless, every trader should have a plan in place, as this is the best method to establish consistency and correctly measure your performance.

Best Forex trading strategies for Beginners

Few traders immediately identify the best Forex trading strategies for beginners. The majority will devote considerable effort to trying various techniques with a demo trading account and/or backtesting. This permits you to carry out your testing in a risk-free setting.

Even if a trader discovers a technique that produces promising results and feels right, it is doubtful that they will remain with that approach for an extended period of time. Financial markets are continuously changing, and traders must adapt to keep up.

If you are a newbie, sticking to simple tactics may be best. Many novice traders make the mistake of attempting to incorporate too many technical indicators into their strategy, resulting in information overload and contradictory signals. You may always change your approach as you go and apply the knowledge you gained from backtesting and demo trading.

Effective Forex Trading Techniques for Beginners

Among the proven strategies for successful Forex trading, we have provided the most common ones as follows:

1. Price action trading

Price action trading is a trading method among other forex trading strategies for beginners, which focuses on making decisions based on the price movements of a specific instrument rather than technical indicators (e.g., RSI, MACD, Bollinger Bands). You can use a range of price action tactics, including breakouts, reversals, and simple and complicated candlestick patterns.

Technical indicators are not typically employed in a price action approach, but if they are, they should be used as a supplement rather than as the primary instrument. Some traders like to use simple indicators such as moving averages to assist spot trends.

Price action trading has the advantage of keeping your charts clean and reducing the risk of information overload. Multiple indicators on your chart can provide contradictory messages, which can be confusing, especially for novices.

Reading price activity can also help you get a better sense of the market and detect patterns more quickly. Another reason why price action trading is so popular among day traders is that it is better suited to traders trying to profit from short-term swings. When day trading, you must make decisions quickly, and having a “clean chart” and focusing just on price activity will help you do so.

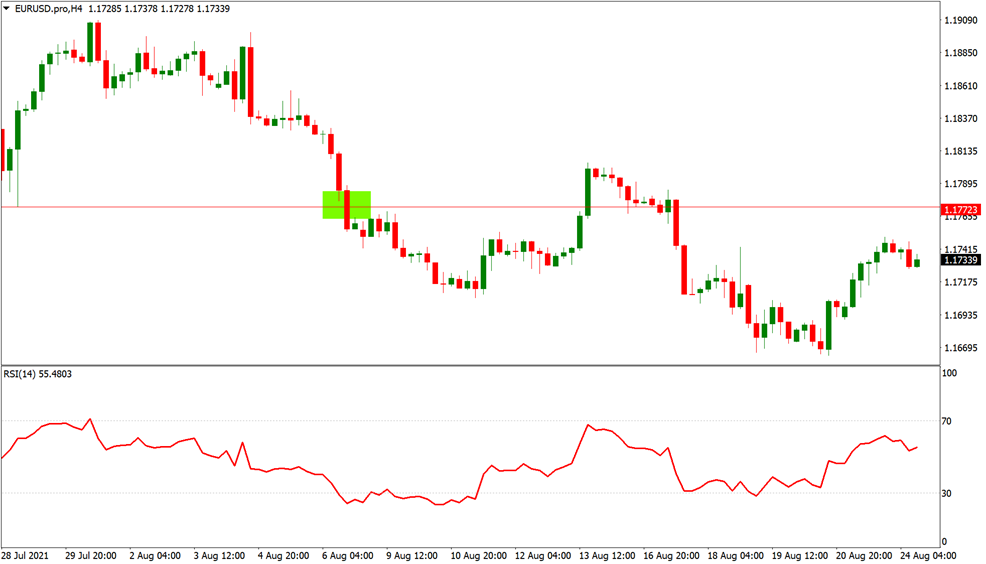

A simple breakout trading strategy is illustrated here. 1.1772 was a key support level, and our trader was hoping for a breakout so they could short EUR/USD and profit on the next wave lower. The general trend is clearly in their favor (downtrend). The currency pair did break out, and it plummeted more than 70 pips before reaching support at 1.1700.

Some traders prefer to enter as soon as the price falls below the crucial support level (possibly with a sell-stop order), whereas others prefer to follow the market action and act later. False breakouts are common, so it is critical to have appropriate risk management policies in place to deal with them.

2. Range trading strategy

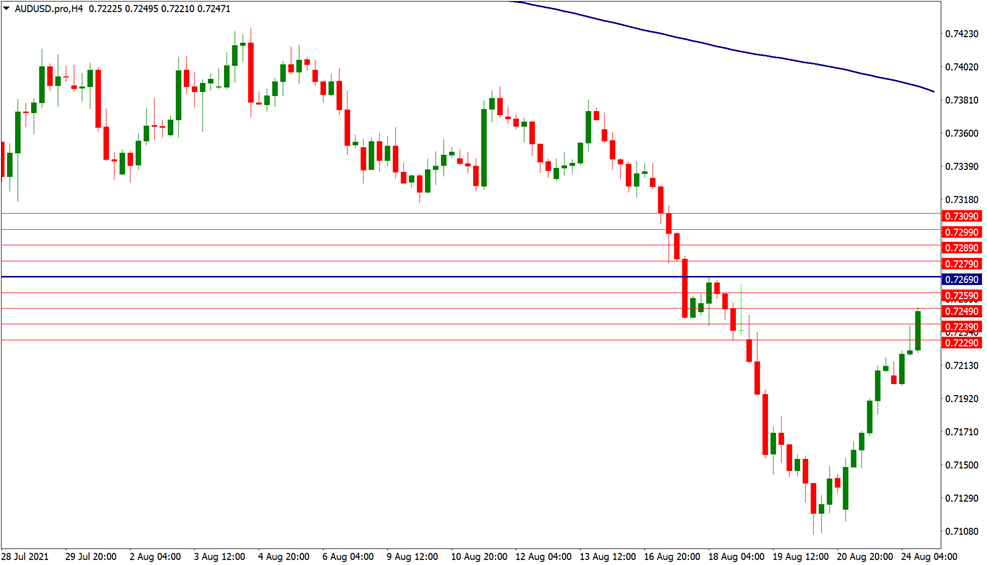

Traders employing a range trading technique, as another subcategory of forex trading strategies for beginners, will seek trading instruments that are consolidating in a specific range. This range could be anything from 20 pips to several hundred pips depending on the timeframe you are trading on. The trader is seeking regular support and resistance zones that hold – that is, the price bouncing off the support region and being rejected at the resistance area.

This approach requires traders to hunt for trading instruments that are not trending. To do so, you can simply observe the instrument’s price activity or use indicators such as the moving average and the average direction index (ADX). The weaker the trend, the lower the ADX rating.

After locating an appropriate trading instrument, you must determine the forex trading strategies for beginners and the range within which the trading instrument is consolidating. A classic range trading strategy will instruct you to sell when the price reaches critical resistance and buy when the price reaches important support.

Some traders will concentrate on two specific levels, while others will trade “bands” or “areas” – for example, if you identified 1.17 as the key resistance level but the price frequently stalls at 1.1690 or 1.1695, you can highlight that area (1.1690 – 1.17) and begin looking for selling opportunities within it. If you only focus on that level, you may miss out on potential trading chances because prices frequently revert before reaching it.

The EUR/SEK currency pair is an example of range trading. Most of the time, the ADX has low readings, and we can see that the price has frequently bounced off the 10.00/04 support area while having difficulty breaking through the resistance area between 10.27 and 10.30.

3. Trend trading strategy

Forex trading strategies for beginners could be trend trading strategies, which entail recognizing trade opportunities in the trend’s direction. The notion is that the trading instrument will continue to move in the same direction (up or down) that it is presently trending.

We’re talking about an uptrend when prices are continually rising (making higher highs). In the opposite direction, falling prices (the trading instrument making lower lows) will signal a downtrend.

With the exception of price movement, traders can employ supporting tools to detect the trend. One of the most used is moving averages. Traders can simply look at whether the price is trading above or below a moving average (the 200 DMA is a prominent and regularly followed moving average) or employ MA crossovers.

Setting a fast MA and a slow MA is required to employ moving average crossovers (which can also be used as entry signals). The 50 DMA and the 200 DMA are two popular examples. The crossover of the 50-day moving average above the 200-day moving average could signal the start of an uptrend, and vice versa.

Here’s an example of the USD/JPY with two DMA crosses (50 DMA and 200 DMA).

4. Position trading

The purpose of position trading, among all the Forex trading strategies for beginners, is to profit from long-term trend changes while avoiding short-term noise that occurs on a daily basis. Traders that use this trading approach may maintain positions open for weeks, months, or, in rare situations, years.

It is one of the more difficult trading styles, along with scalping. It takes a very disciplined trader who can ignore the noise and remain cool even when a position moves against them for hundreds of pips.

suppose you had a pessimistic opinion of markets in early 2018. You shorted the S& P 500 at the start of the year with the intention of holding the position for the remainder of the year. While the price swings at the beginning and end of the year would have been enjoyable, the climb from March to September may have been a bitter experience. Only a few traders have the discipline to hold their positions for such an extended length of time.

5. Day trading strategy

Day traders do not typically hold trades for only a few seconds, as scalpers do. However, their trading day is often centered on a specific session or time of day when they attempt to capitalize on opportunities. While scalpers may trade on an M1 chart, day traders typically trade on anything from the M15 to the H1 chart.

Scalpers typically open more than 10 trades per day (some highly active traders may open more than 100 per day), whereas day traders take it a little slowly and look for 2-3 solid opportunities per day.

If you want to terminate your positions before the trading day ends but don’t want the extreme degree of pressure that comes with scalping, day trading may be for you.

6. Scalping strategy

When scalping, traders attempt to profit from minor intraday price movements. Some even have a 5 pip per transaction target, and the trade length can range from seconds to a few minutes. Scalpers must be strong with statistics and be able to make quick decisions under pressure. They also spend more time in front of the screen and tend to specialize in one or a few markets (for example, just scalping EUR/USD or only S& P 500 futures).

The benefit of being a scalper is that you can focus on the market in a narrow timeframe without having to worry about maintaining holdings overnight or deciphering long-term fundamentals.

Scalping, on the other hand, comes with a lot of pressure because you must be completely concentrated during your trading session. Furthermore, since your trades are only running for a few minutes, it is simpler to make mistakes and react emotionally. As a result, it may not be one of the best forex trading strategies for beginners to start with.

7. Swing Trading

There are more forex trading strategies for beginners among which “Swing Trading” refers to traders who keep their positions open for several days. They may utilize an H1 chart, a D1 chart, or even a weekly chart. Trend following, range trading, and breakout trading are all popular trading methods.

Traders that adopt this trading method must be patient and disciplined. It could take days for a good opportunity to present itself, or you could end yourself holding a trade open for a week or more while losing money. Some traders lack the essential patience and close trades too soon.

Swing trading may be the appropriate trading technique for you if you enjoy analyzing markets without feeling rushed and are comfortable holding positions for days or even weeks. It also allows you to integrate basic analysis (trying to predict monetary policy changes or political events), which is impossible to do with scalp trading.

8. Carry trade strategy

One of the forex trading strategies for beginners is Carry Trade Strategy, according to which, A trader employing a carry trade strategy will attempt to profit from the difference in interest rates between the two currencies that comprise a currency pair.

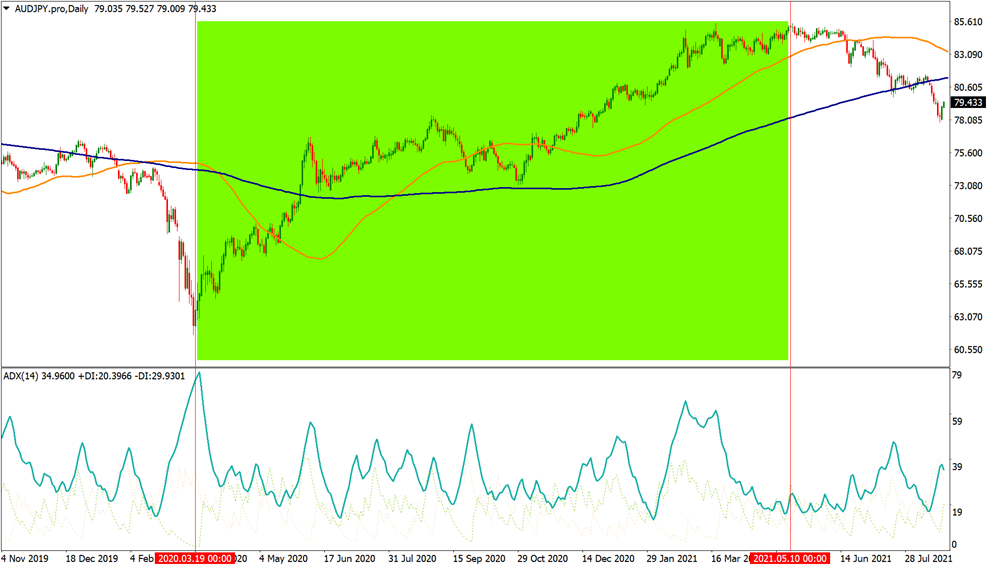

A trader would go buy a high-interest-rate currency and sell a low-interest-rate one. Going long AUD/JPY is a prominent example (owing to Australia’s historically high and Japan’s historically low-interest rates). Considering the best forex trading strategies for beginners, a trader will receive an interest rate payment dependent on the amount of their position as a result of doing so.

The advantage of a carry trading strategy, as one of the best forex trading strategies for beginners, is that you can earn a lot of money just by holding a position. Of course, the correct market climate is required for this to succeed. If the AUD/JPY is in a significant downturn and you are long, the interest payments will not compensate for the overall negative PnL.

When traders are looking for high risk, carry trades perform well in a bullish market scenario. Because the Japanese Yen is a historic safe haven, many carry trades involve selling the Yen against another “risk-on” currency.

You should, however, be conversant with the features of the currency you are purchasing. For example, rising commodity prices will boost the Australian Dollar, whereas rising oil prices will benefit the Canadian Dollar, and so on.

The AUD/JPY chart below highlights a period when the currency pair was performing exceptionally well, and a carry trade would have made perfect sense.

9. Breakout strategy

Among the forex trading strategies for beginners, a breakout strategy seeks to enter a trade as soon as the price breaks out of its trading range. Traders who look for the best forex trading strategies for beginners seek high momentum, and the real breakout is the indication to enter the trade and profit from the subsequent market action.

Traders can enter positions in the market by either attentively monitoring price action or by setting buy-stop and sell-stop orders. They will normally position the stop just below or above the previous resistance or support level. Traders can use traditional support/resistance levels to determine their exit points.

10. News trading

News trading is a trading method among other forex trading strategies for beginners, in which the trader attempts to profit from a market shift caused by a major news event. This could range from a central bank meeting and economic data release to an unanticipated incident (natural disaster or growing geopolitical tensions).

News trading can be particularly risky because the market is extremely volatile during certain periods. You may also notice a considerable increase in the spread of the impacted trading products. Because liquidity is draining, you are also in danger of slippage, which means your transaction may be executed at a substantially lower price than expected or you may struggle to exit your trade at the level you intended.

So, now that you’re aware of the dangers, let’s look at how you could profit from the news.

First and foremost, you must decide which event you wish to trade and which currency pair(s) it will have the greatest impact on. The European Central Bank meeting will almost definitely have the greatest impact on the Euro. However, which currency pair should you choose? If you anticipate a hawkish ECB signaling rate hikes, a low-yielding currency, such as the Japanese Yen, might be a good choice. EUR/JPY may thus be the best option.

Furthermore, you may approach news trading with or without prejudice. It implies that you have an idea of where you think the market will move based on how the event unfolds. News trading without bias, on the other hand, comprises aiming to capture the significant move regardless of its direction.

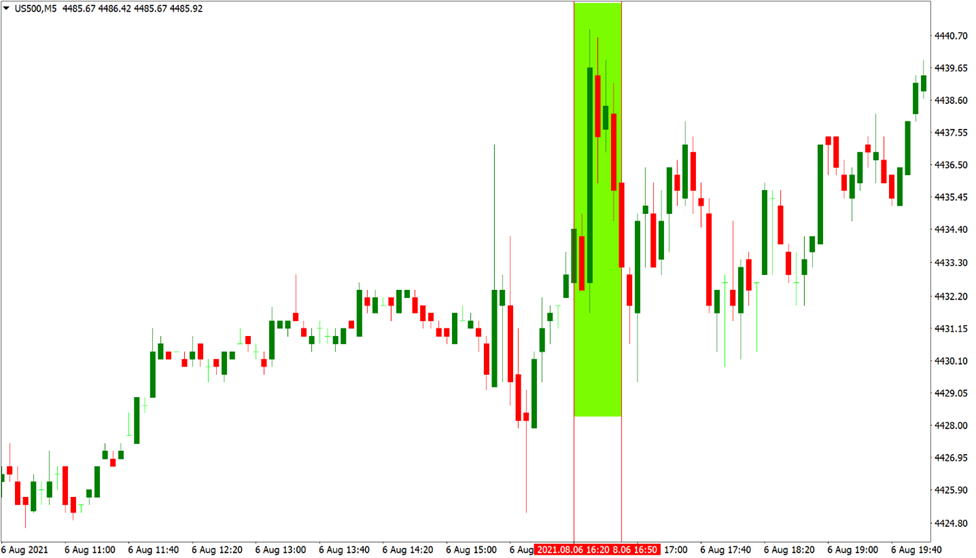

The figure below depicts the US500’s reaction to the July NFP announcement.

11. Retracement trading

Temporary variations in the direction of a trading instrument are included in retracement trading. Retracements should not be confused with reversals; reversals signify a significant change in the trend, whilst retracements are only minor pullbacks. Trading retracements keep you trading in the trend’s direction. You are attempting to profit from short-term price reversals inside a larger price trend.

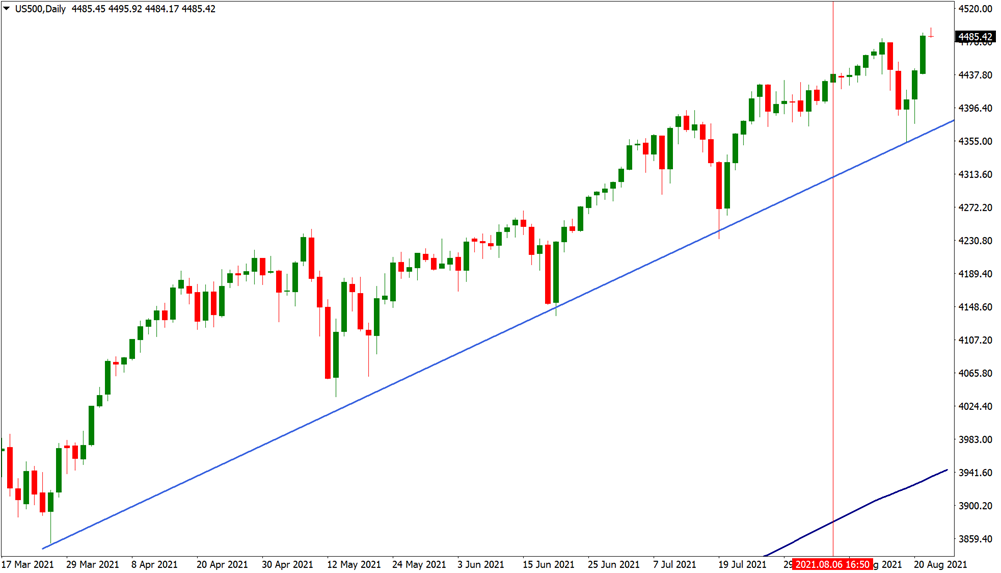

You can trade retracements in a variety of ways. You could, for example, utilize trendlines. Let’s have a look at the US500 chart below. The index is clearly in an uptrend, and the rising trendline may have provided a buying opportunity (until the price tested the actual trendline).

Fibonacci retracements, notably the 38.2%, 61.8%, and 78.6% levels, are another popular method for trading retracements.

12. Grid trading

When considering forex trading strategies for beginners, you may find out that Grid trading is the practice of placing several orders above and below a specific price. The objective is to profit from volatility by placing buy and sell orders at regular intervals above and below the defined price level (for example, every 10 pips above and below the set price level).

If the price moves in a single direction, your position grows, as does your floating PnL. Of course, there is a risk of false breakouts or a quick reversal.

How to Distinguish the Best Forex Trading Strategies for Beginners

To distinguish the best forex trading strategies for beginners, try them out with virtual dollars in a demo setting. When you’ve decided which one is ideal for you, consider putting it to the test in a live setting. Even then, the procedure is not complete.

Some traders may find day trading appealing at first, but then switch to swing trading later in their trading career. Traders’ and investors’ preferences change in tandem with the market environment.

In addition, you can take one of the many free personality tests available on the internet, which may give you further insights.

Forex trading strategies for beginners summed up

• Understanding currency pairs, choosing your trading style, deciding how to trade FX, developing your strategy, and risk management are all part of the forex trading basics.

• As one of the forex trading strategies for beginners, the trend trading technique entails employing technical indicators to determine the market momentum’s direction.

• A range trading technique involves determining if currencies are trading within a specific price range and then going long or short based on the price’s position within that range.

• A breakout trading method entails entering an FX position relatively early in a new trend and putting your stop-loss order at the instant the market broke out.

• The goal of the momentum trading technique is to enter a position when the trend develops momentum and exit when the trend begins to slow.

• Among other important forex trading strategies for beginners, the news trading technique involves monitoring significant political and economic events to see how they affect the price of a currency pair.

• The carry trade strategy’s goal is to assist you in profiting from the interest rate differential between two currencies in a forex pair.

• Moving average lines are used in the MACD trading method to evaluate potential buy or sell signals.

• To begin trading forex as a novice, study everything you can about forex, forex trading strategies for beginners, and then open a trial account with us to begin practicing.

Risk Management in Forex Trading

Risk management, as one of the forex trading strategies for beginners, allows you to put in place a set of rules and methods to ensure that any unfavorable consequences of a forex trade are manageable. An effective approach necessitates good planning from the start, as it is preferable to have a risk management plan in place before you begin trading.

Risks of Forex Trading for Beginners

- Currency risk is the risk linked with currency price fluctuations, which make purchasing overseas assets more or less expensive.

- Interest rate risk is the risk associated with a sudden rise or fall in interest rates, which impacts volatility. Interest rate fluctuations have an impact on currency prices because the level of spending and investment in an economy will rise or fall based on the direction of the rate shift.

- Considering forex trading strategies for beginners, liquidity risk is the danger of being unable to acquire or sell an asset quickly enough to avoid a loss. Even though forex is a relatively liquid market, there may be periods of illiquidity based on the currency and government policy regarding foreign exchange.

- Leverage risk is the risk of having losses multiplied when trading on margin. Because the initial expenditure is less than the value of the FX exchange, it’s easy to lose sight of the amount of capital at stake.

Conclusion

Forex trading strategies for novice traders necessitate a methodical approach, ongoing learning, and practice. Beginners might potentially establish excellent methods for lucrative trading in the forex market by following these steps and being disciplined. Remember that patience and perseverance are essential for long-term success in a step-by-step guide to forex trading strategies for beginners.