Crypto Spot trading can be described by its goal, mode of operation, and trading strategy. The purpose of cryptocurrency trading, for example, is the asset being exchanged, or cryptocurrency. The way cryptocurrencies are traded depends on the sort of transaction that takes place on the market, such as Futures, options, or everlasting contracts.

Cryptocurrencies have seen quick growth and extensive market adoption since their introduction, as indicated by the assets linked to crypto assets that have begun appearing in several asset managers’ portfolios and crypto trading strategies. Cryptocurrency trading is the process of buying and selling cryptocurrencies for profit.

This article will go over what crypto Spot trading is, what cryptocurrency Spot trading signals are, how to execute crypto Spot trading, and what the risks of crypto Spot trading are.

Quick Getaway: Looking for a safe platform that offers the most secure cryptocurrency trading platform? Sign up with Coinlocally and enjoy the best Cryptocurrency trading strategies.

Table of Contents

• What is a Spot Market in Crypto?

• What is Spot Trading in Crypto?

• How Does Crypto Spot Trading Work?

• Pros & Cons of Crypto Spot Trading

• How to Execute Crypto Spot Trading on Coinlocally?

• Spot Trading vs. Futures Trading

• Crypto Spot Trading vs. Margin Trading

What is a Spot Market in Crypto?

A Spot market is a basic market where crypto assets are instantly swapped and settled, and trading in this market includes purchasing digital currencies such as Bitcoin or other altcoins and hoarding them until their value rises.

The term “Spot trading” refers to transactions that are settled “on the Spot.” Spot markets also comprise sellers, buyers, and order books. Sellers place an order with a specific ask or sale price, and buyers place an order with a certain bid or purchase price for any cryptocurrency token. The bid price is the most a buyer is willing to pay, and the ask price is the least a seller is willing to take as payment.

The order book is divided into two sections: the ask side for buyers looking to buy and the bid side for sellers looking to sell. In the order book, bids and asks are recorded. In Spot trading, for example, if Bob places an order to buy BTC, the transaction is immediately routed to the bid side of the order book. This order is immediately filled when a seller from the crypto Spot trading platform sells at the same specifications.

When Bob executes an order to sell BTC in the preceding crypto Spot trading example, the transaction moves to the ask side of the order book. Orders in green in the order book represent buyers of a given token, whereas orders in red represent sellers of that token.

What is Spot Trading in Crypto?

The purpose of Spot trading is to buy low and sell high in order to profit, however, given the volatility of the crypto market, this strategy may not always work to the traders’ advantage.

The three most important ideas in Spot trading are the Spot price, trade date, and settlement date. The current price of any asset is known as the Spot price, and traders can sell goods under consideration at this price right away. Furthermore, on multiple exchange platforms, users can purchase and trade bitcoins with one another.

As new orders are placed and existing ones are filled, the Spot price fluctuates. The trade date begins and records the transaction, and it indicates the day on which the market executes the trade. On the settlement date, also known as the Spot date, the assets involved in the transaction are actually transferred.

Depending on the market, there could be a day or several days between the trade date and the settlement date. It normally happens on the same day for cryptocurrency, though it may differ amongst exchanges or trading platforms.

How Does Crypto Spot Trading Work?

On an exchange, a market order allows traders to buy or sell assets at the best available Spot price. A Spot market often offers a wide range of currencies, including BTC, Ether, and even fiat. On many cryptocurrency exchanges, such as Coinlocally or Binance, there are numerous techniques for purchasing and selling coins, and Spot traders commonly employ a variety of fundamental and technical research approaches to make trading decisions.

Crypto Spot trading can be done at centralized exchanges, decentralized exchanges (DEXs), or over-the-counter (OTC) markets. To utilize a centralized exchange, you must first fund your account with the cryptocurrency you wish to trade. Fees are frequently levied on listings, transactions, and other trading operations on centralized exchanges.

DEXs leverage blockchain technology to match buying and selling orders, and smart contracts allow crypto Spot trading methods to be executed straight from a trader’s wallet. Trading can take place directly on OTC platforms, through brokers that execute deals on their client’s behalf, or even over the phone in the Internet age.

Pros & Cons of Crypto Spot Trading

When you buy an asset at the Spot price, you genuinely own it, allowing traders to sell it or move it to offline storage whenever they choose. Furthermore, crypto Spot trading allows traders to use their digital assets for other purposes such as online payments or staking.

Furthermore, crypto Spot trading is far less dangerous than margin trading, which means that one can invest in crypto assets without fear of losing money due to price fluctuations or dealing with margin calls. As a result, because there are no margin calls, the trader does not run the risk of contributing more of their own money or losing more money than they already have in their account.

The main disadvantage of crypto Spot trading is that it does not provide the benefit of any potential return amplification that leverage in margin trading may provide. Furthermore, because leverage is not available, prospective gains in the Spot market are fewer than in margin trading.

How to Execute Crypto Spot Trading on Coinlocally?

After you’ve opened a Coinlocally account, crypto Spot trading on the site is a simple process. Coinlocally has 0% crypto Spot trading fees for BTC and BUSD Spot trading pairings. The following are the steps to Spot trade on Coinlocally:

1. Select “Trade” and then “Spot” on the Coinlocally website to access the crypto Spot trading platform.

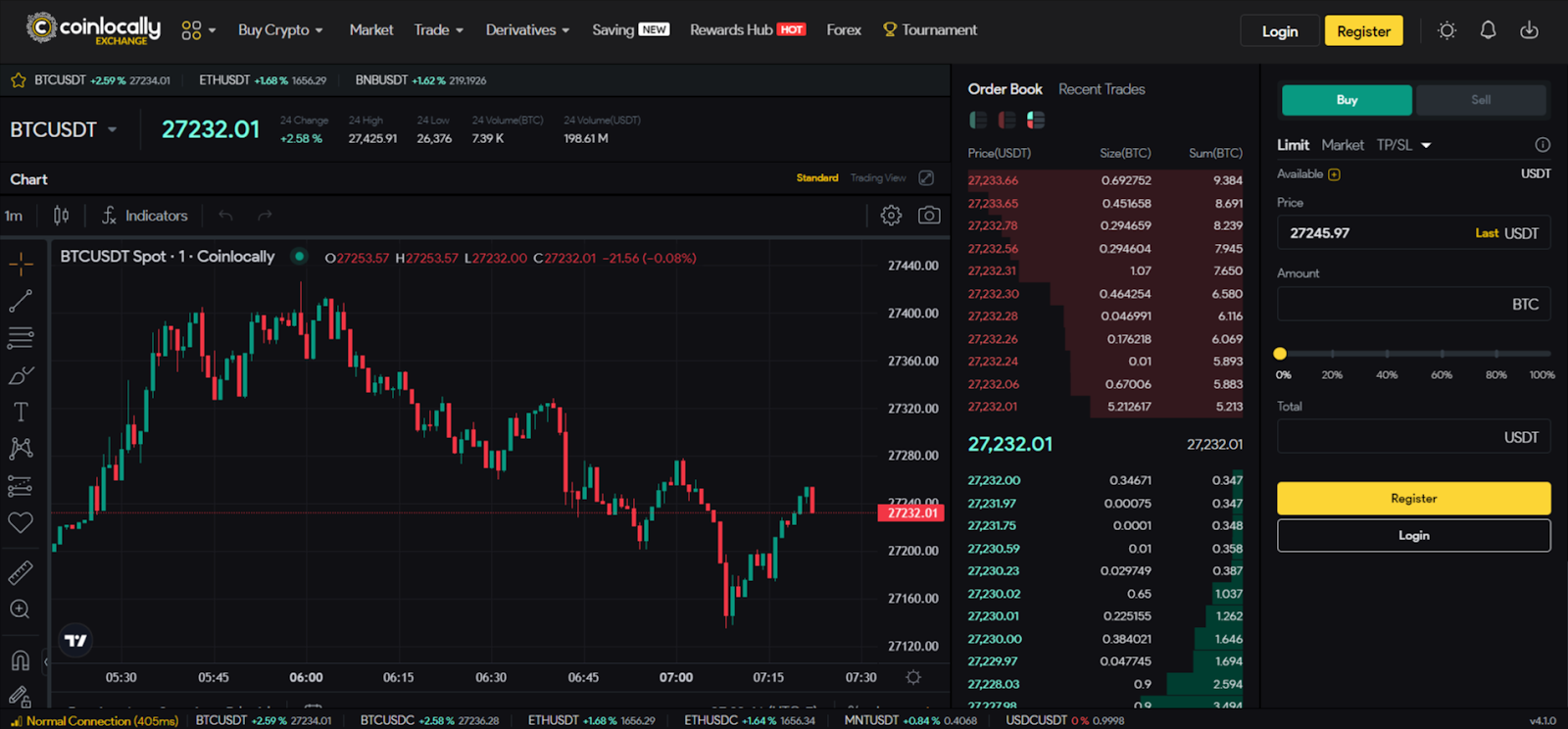

2. You will now be able to see the trade view interface, which contains a few intriguing components.

3. At the top, the cryptocurrency trading pair and other market data, such as daily price change and volume, are presented.

4. The order book lists all open purchase and sell orders for an asset, organized by price. In this chart view, the past price data can be customized. TradingView, which is already integrated into the window, gives you access to a wide range of technical analysis tools.

5. In the top right corner, one can search for different trade pairs. By clicking on the tiny stars, you can bookmark your favorite cryptocurrency pairs and choose which one you want to trade on the Spot market.

6. This is where one’s buy or sell order will be created. To make a crypto Spot trading transaction, they can choose between limit, market, and stop-limit orders.

Spot Trading vs. Futures Trading

As previously stated, Spot deals are executed in real-time for rapid delivery. Contracts on the Futures market, on the other hand, are paid for later when a buyer and seller agree to exchange a specified amount of items for that price. Rather than handing over the asset after the contract expires on the settlement date, the buyer and seller frequently agree on a financial settlement.

The following table compares the differences between these two methods of trading:

| Spot Trading | Futures Trading | |

|---|---|---|

|

Investment Strategy |

Traders buy assets and hold them to sell at a later date when the price of the asset under consideration rises. |

Traders agree to buy or sell cryptocurrencies at a predetermined price and at a set date. |

|

Purpose |

Taking delivery of the underlying asset immediately |

Hedge the risk position |

|

Investment Principle |

Buy low, sell high |

Go long or short |

Crypto Spot Trading vs. Margin Trading

In crypto Spot trading, day traders open short-term trades with low spreads and no expiration date to take immediate delivery of the underlying asset. In trade, a spread is the difference between the offer (buy) and bid (sell) prices quoted for an asset.

Margin trading, on the other hand, allows traders to take on larger holdings by borrowing money from a third party at interest in order to possibly make huge gains. However, it is critical to exercise prudence so that you do not lose your entire initial investment because it compounds any potential losses.

The following table summarises the differences between Spot and Margin trading:

|

Spot Trading |

Margin Trading |

|

|

Use of Leverage |

Does Not Use Leverage |

Uses Leverage |

|

Profit Opportunities |

Makes profit when price rises |

Makes profit when price moves in either direction (Up or Down) |

|

Capital Requirement |

Higher |

Lower |

|

Investment Principle |

Lower |

Higher |

Is Crypto Spot Trading Profitable?

To profit from crypto Spot trading, traders typically employ a dollar-cost averaging technique and wait for the next bull market. However, benefits come at the expense of patience, and nothing in the unpredictable crypto market is instant. Furthermore, before trading in any crypto assets or employing Spot trading tactics, it is prudent to undertake due diligence and risk management to avoid losses. Is crypto Spot trading suitable for beginners?

Each investor has a different risk-return profile, and given the very unpredictable cryptocurrency market, one should assess the benefits and drawbacks of their preferred trading technique (in this case, Spot trading). This means that traders must exercise caution when determining which assets to trade and must be well-versed in the market before engaging in transactions.

Conclusion

Crypto Spot trading refers to the buying and selling of cryptocurrencies for immediate settlement. In spot trading, traders purchase digital assets at the current market price and own the actual coins or tokens.

Unlike derivatives or Futures contracts, spot trading involves the direct ownership of cryptocurrencies, allowing traders to hold them in wallets or transfer them to other exchanges or individuals. Crypto Spot trading is popular among investors and individuals who seek to acquire and hold cryptocurrencies for the long term or engage in short-term trading based on market conditions.