Top 10 altcoins as the cryptocurrency industry develops beyond Bitcoin and Ethereum with great intensity, is the significant question traders and investors have in mind when searching for opportunities. Altcoins, or alternative cryptocurrencies, have become a respectable choice for expansion and financial success. According to analysts, several altcoins are expected to be top 10 altcoins and see significant returns in 2023—up to 30 times the initial investment. These cryptocurrencies are unique due to their innovative use cases, strong project teams, and state-of-the-art technology.

This piece will examine the best altcoins to buy and the top 10 altcoins predicted to see rapid growth in 2023. We aim to offer perceptive justifications for why these altcoins might be profitable. But it’s important to understand that investing in cryptocurrencies has its own risks. Before making any decisions, investors should thoroughly consider their risk tolerance and undertake extensive research.

Quick Getaway: Looking for a safe platform that offers the most secure cryptocurrency trading platform? Sign up with Coinlocally and enjoy the best Cryptocurrency trading strategies.

Table of Contents

• Points to Take into Account Before Investing in Altcoins

• Altcoin Market Capitalization

• The Historic Performance of Alternative Coins

What is an Altcoin?

Coins that are not Bitcoin (BTC) are referred to as altcoins, a term derived from the word “alternative coins.” However, some continue to use the term “altcoins” to refer to any cryptocurrency other than Bitcoin and Ethereum. True, these two are the source of most other coins. They may differentiate themselves from Bitcoin by providing unique or superior features and services or using other consensus protocols for block creation and transaction verification.

Within their blockchains, these coins have unique functions to perform. For example, Ethereum pays transaction fees using its own currency, Ether. As evidenced by Bitcoin Cash, developers have created cryptocurrency forks to threaten its dominance. Certain altcoins serve as tools for project fundraising.

Alternative cryptocurrencies typically seek to improve the drawbacks of the cryptocurrencies and blockchains they either compete with or derive from. In 2011, Litecoin—the first altcoin—was created after a split from Bitcoin. It uses Scrypt, an alternative Proof-of-Work (PoW) consensus algorithm that is faster and uses less energy than Bitcoin’s SHA-256 PoW algorithm.

Different types of altcoins:

• Security Tokens – Tokenized security assets

• Payment Tokens – Used as currency

• Stablecoins – Peg their value to fiat currency or other cryptocurrencies

• Utility tokens – Offer services within a network

• Meme coins – Coins that were made as a joke

Points to Take into Account Before Investing in Altcoins

When making an altcoin investment, there are a few essential things to remember. The altcoin’s team is crucial, in addition to its market capitalization and historical success. A proficient and competent project team can have a significant impact. Examine their history, expertise, and prior accomplishments. Analyze their ability to fulfill commitments and get through any challenges. A dedicated and knowledgeable team can inspire confidence in the long-term potential of a cryptocurrency. Therefore, remember to do your homework and consider these factors before investing in altcoin.

Altcoin Market Capitalization

You must first and foremost examine the market capitalization of the altcoin. It can be used to assess a cryptocurrency’s stability, future growth potential, and total value. With remarkably more significant market capitalization, altcoins are frequently more established and less prone to extreme volatility.

The Historic Performance of Alternative Coins

The altcoin’s prior performance is another factor to take into account. Even though past performance cannot predict future results, it can offer important insights about the altcoin’s success. Look at its price charts to determine if there have been any significant shifts or ongoing upward tendencies. Naturally, it’s important to learn more and understand the causes of these patterns. Collaborations, technological advancements, and community involvement can all affect an altcoin’s performance.

The Top 10 Altcoins to Invest in Across Future

While certain cryptocurrencies are appropriate for short-term investing strategies like day trading or “scalping,” we’ll concentrate on the ones that require HODLing to yield the most returns on your capital. After altcoin market analysis and removing stablecoins from the list, let’s look at the top 10 altcoins and altcoins for long-term growth, determined by market value. Stablecoins are designed to keep prices stable. Since they are typically used for a different kind of investing plan, they are not usually considered speculative investments. Thus, our focus will be on cryptocurrencies that have the potential to expand and revolutionize the market significantly.

1. Ethereum

With a market valuation of almost $210 billion, Ethereum is close behind Bitcoin in second place and is considered as one of the top 10 altcoins.

Although most people associate Bitcoin with the term “decentralized currency,” Ethereum is more notable as a distributed computer network. It serves as a platform for users to host smart contracts and execute decentralized apps (dApps), promoting blockchain technology innovation.

The problem of excessive transaction costs is one that Ethereum critics frequently bring out. But given the wide range of uses and other altcoins dependent on its blockchain, Ethereum has solidified its position as a significant player in the cryptocurrency market, demonstrating its sturdiness and long-term sustainability.

It is a promising investment option because of its strong infrastructure, expanding user base, and planned updates like Ethereum 2.0, which switched from a Proof-of-Work to a Proof-of-Stake consensus method. Ethereum is a favorite among developers and investors due to its lively ecosystem and capacity to simplify the development of diverse applications.

• Initial release: July 30, 2015

• Original Authors: Vitalik Buterin (Additional founders: Gavin Wood, Charles Hoskinson, Anthony Di Iorio, and Joseph Lubin)

• Ticker: ETH

• Current Price: $1,914

• Current Market Cap: $229,734,638,553

• Circulating supply: 120,199,213 ETH

• Total supply: 120,199,213 ETH

• All-time high: $4,891.7 (Nov 16, 2021)

• All-time low: $0.4209 (Oct 22, 2015)

2. Cardano (ADA)

Cardano, which has an $11 billion market valuation, is a prominent proponent of the proof-of-stake consensus mechanism and one of the top 10 altcoins. In contrast to Bitcoin, which depends on energy-intensive and competitive problem-solving techniques, Cardano’s proof-of-stake mechanism expedites the processing of transactions.

Cardano is a well-known player in the market and a pioneer in using proof of stake consensus techniques. In contrast to many of its competitors, ADA, the native cryptocurrency of Cardano, provides a blockchain solution with reduced fees and increased security.

• Initial release: 2015

• Original Authors: Charles Hoskinson & Jeremy Wood

• Ticker: ADA

• Current Price: $0.3244

• Current Market Cap: $11,350,786,188

• Circulating supply: 34,986,784,284 ADA

• Total supply: 35,983,607,756 ADA

• All-time high: $3.1 (Sep 02, 2021)

• All-time low: $0.01735 (Oct 2, 2017)

3. Binance Coin (BNB)

The native coin of the largest cryptocurrency exchange, Binance, is called Binance Coin, among top 10 altcoins. Because of its many applications, Binance Coin (BNB), which has a $37 billion market valuation, has become incredibly popular. It can primarily be used to pay trading commissions on the Binance exchange, giving customers the benefit of cheaper deals. Remarkably, BNB’s capabilities go well beyond the confines of the Binance cryptocurrency market, and it can be used for processing payments in various situations, including making trip reservations.

On the other hand, detractors contend that BNB is not as decentralized as other altcoins. Furthermore, the Securities and Exchange Commission’s (SEC) ongoing inquiry has given rise to worries. This study aims to ascertain if Binance should have registered BNB as a security during its initial coin offering. This may have put the cryptocurrency’s future at risk from regulatory action.

• Initial release: 30 July 2015

• Original Authors: Changpeng Zhao

• Ticker: BNB

• Current Price: $244.2

• Current Market Cap: $37,263,493,830

• Circulating supply: 153,857,113 BNB

• Total supply: 153,857,113 BNB

• All-time high: $690.93 (May 10, 2021)

• All-time low: $0.09611 (Aug 01, 2017)

4. DOT Polkadot

A multi-chain framework called Polkadot, as one of the top 10 altcoins, allows different blockchains to communicate with one another. It is a desirable long-term investment because of its capacity to provide smooth communication and data transmission across multiple networks, especially as the blockchain sector develops. Polkadot is well-positioned for possible long-term growth because of its emphasis on scalability, security, and interoperability.

• Initial release: May 2020

• Original Authors: Gavin Wood, Robert Habermeier, and Peter Czaban

• Ticker: DOT

• Current Price: $5.40

• Current Market Cap: $6,31,365,336

• Circulating supply: 1,206,715,835 DOT

• Total supply: 1,336,194,712 DOT

• All-time high: $55 (Nov 04, 2021)

• All-time low: $2.69 (Aug 20, 2020)

5. Dogecoin (DOGE)

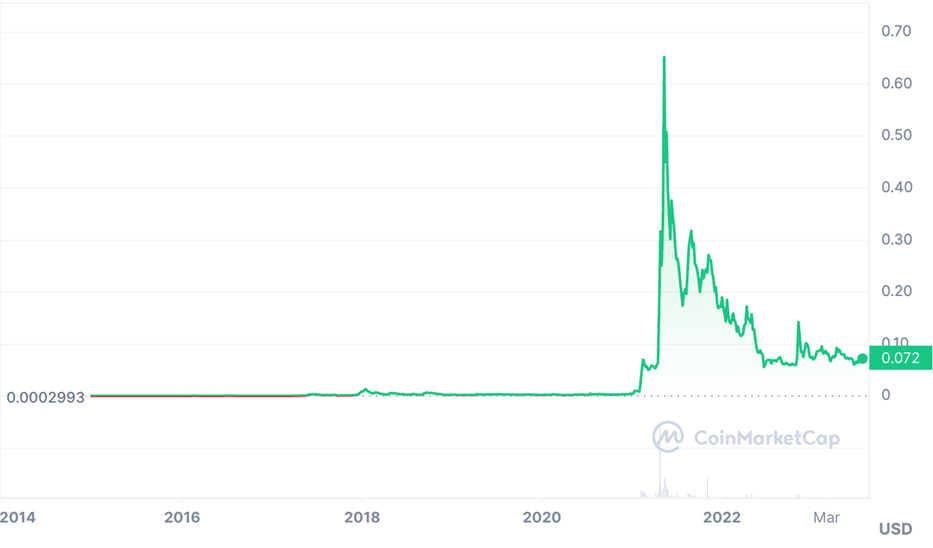

Due to its quick ascent to fame and Elon Musk’s endorsements, Dogecoin, another leading altcoin among top 10 altcoins, has become cult-like within the global crypto community. Although the first cryptocurrency emerged from an Internet meme, it is now known as a “tipping” currency. Users quickly used Dogecoins to tip content creators on Twitch and YouTube instead of useless upvotes, likes, and retweets.

• Initial release: December 6, 2013

• Original Authors: Billy Markus & Jackson Palmer

• Ticker: DOGE

• Current Price: $0.072

• Current Market Cap: $9,949,527,270

• Circulating supply: 140,239,566,384 DOGE

• Total supply: 140,239,566,384 DOGE

• All-time high: $0.7376 (May 08, 2021)

• All-time low: $0.00008547 (May 07, 2015)

6. Litecoin (LTC)

One of the original altcoins and one of the top 10 altcoins, Litecoin, was created expressly to overcome the perceived drawbacks of Bitcoin. With a $6.9 billion market valuation, Litecoin outperforms its predecessor regarding transaction processing speed to facilitate quicker and more effective transactions. Moreover, Litecoin aims to dispel worries about Bitcoin-related mining monopolies.

While Bitcoin has steadily evolved into a virtual “store of value,” Litecoin prioritizes making daily transactions easier. This distinction between the two cryptocurrencies highlights Litecoin’s goal to function as a useful means of exchange in day-to-day business dealings.

• Initial release: 7 October 2011

• Original Authors: Charlie Lee

• Ticker: LTC

• Current Price: $93.69

• Current Market Cap: $6,824,124,954

• Circulating supply: 84,000,000 LTC

• Total supply: 84,000,000 LTC

• All-time high: $412.96 (May 10, 2021)

• All-time low: $1.11 (Jan 15, 2015)

7. Chainlink (LINK)

Chainlink is a decentralized oracle network, among top 10 altcoins, that links external APIs and real-world data to smart contracts. Major corporations have taken notice of its innovative strategy for integrating the blockchain and real-world applications, establishing it as a reliable long-term investment alternative. Developers increasingly depend on Chainlink to pull data from the outside world as more work is being done on top of L1 and L2 blockchains.

Chainlink’s native token is called LINK. Its market value is $3.7 billion.

• Initial release: 2017

• Original Authors: Sergey Nazarov, Steve Ellis, Dr. Ari Juels

• Ticker: LINK

• Current Price: $8.22

• Current Market Cap: $4,423,181,045

• Circulating supply: 1,000,000,000 LINK

• Total supply: 1,000,000,000 LINK

• All-time high: $52.88 (May 10, 2021)

• All-time low: $0.1263 (Sep 23, 2017)

8. Stellar (XLM)

Stellar is a blockchain platform made to make cross-border transactions quick and affordable. Stellar is an investment choice with a social impact, among other top 10 altcoins, because it seeks to give cheap financial services to the unbanked and underbanked masses worldwide. It is a strong alternative coin for long-term investment because of its alliances with reputable financial institutions and emphasis on financial inclusion.

• Initial release: July 31, 2014

• Original Authors: Jed McCaleb & Joyce Kim

• Ticker: XLM

• Current Price: $0.1665

• Current Market Cap: $4,527,457,818

• Circulating supply: 27,156,306,743 XLM

• Total supply: 50,001,787,272 XLM

• All-time high: $0.9381 (Jan 04, 2018)

• All-time low: $0.001227 (Nov 18, 2014)

9. Solana (SOL)

High-performance blockchain platform Solana, as a significant coin among all the othertop 10 altcoins, is renowned for its scalability and quick transaction times. Because of its expanding ecosystem, developer-friendly architecture, and rising popularity, this altcoin is worth considering for long-term investment.

Solana has emerged as a blockchain for decentralized apps, banking, and smart contracts. Its foundational architecture is based on a unique blend of proof-of-history and hybrid proof-of-stake techniques, enabling quick and safe transaction processing.

Solana is well-known for its remarkable speed and efficiency among other top 10 altcoins. Despite criticism for its extreme centralization, it has grown to a $8.3 billion market capitalization.

• Initial release: 2020

• Original Authors: Anatoly Yakovenko & Raj Gokal

• Ticker: SOL

• Current Price: $26.78

• Current Market Cap: $10,785,427,825

• Circulating supply: 402,764,461 SOL

• Total supply: 552,798,486 SOL

• All-time high: $260.06 (Nov 6, 2021)

• All-time low: $0.5052 (May 11, 2020)

10. Polygon (MATIC)

Ethereum is a well-known blockchain for working with different applications and smart contracts. On the other hand, as these apps gain traction, the Ethereum network’s transaction costs are increasing. To solve this problem, Polygon developed as a Layer 2 scaling solution or sidechain, offering cheaper and faster transactions.

In addition to Ethereum, Polygon is a parallel blockchain that users may utilize to connect their cryptocurrency holdings and access several well-known crypto applications. MATIC, the cryptocurrency Polygon employs, is used for staking, governance, and fee payments. Voting rights for Polygon’s revisions are granted to MATIC holders. Exchanges such as Coinbase allow for the buying and selling of MATIC. Before changing its name to Polygon in early 2021, Matic Network was its prior name.

• Initial release: 2017

• Original Authors: Jaynti Kanani, Sandeep Nailwal, Anurag Arjun, and Mihailo Bjelic

• Ticker: MATIC

• Current Price: $0.788

• Current Market Cap: $7,017,996,104

• Circulating supply: 9,319,469,069 MATIC

• Total supply: 10,000,000,000 MATIC

• All-time high: $2.92 (Dec 27, 2021)

• All-time low: $0.003 (May 09, 2019)

Conclusion

While investing on top 10 altcoins and the top altcoins for 2023 can be profitable, it must be done carefully and thoroughly. Based on their potential for long-term growth and distinctive qualities, the top 10 cryptocurrencies featured in this listicle—Ethereum, Cardano, Binance Coin, Polkadot, Dogecoin, Litecoin, Chainlink, Stellar, Solana, and Polygon—have been chosen.

There are inherent dangers associated with investing in altcoins, and making wise investment selections requires careful research. Nonetheless, investors need to evaluate the risks, do their due diligence, and keep up with the ever-changing cryptocurrency market. Investors may make smarter long-term investments in altcoins by taking into account the aspects covered and staying up to date on the most recent changes in the altcoin market.